Using your tax dollars to drain the life from your community

The Port of Seattle is much more than an airport or a seaport. It works diligently to be the economic engine of King County. By virtue of its status as a Port District under RCW 53, and as owner and operator of a Class I Airport, they have a set of financial powers unlike any other agency. It wields these strategically to promote a variety of policies for the entire region. Many of these are highly coveted by local governments, despite the fact that these tend to make the Port stronger while weakening many communities under the flight path. This pattern has become a form of codependency, bordering on seduction.

This is power

- As the owner of Sea-Tac Airport the Port is eligible for hundreds of millions of dollars in Federal grants every year to further its strategic goals. It can use those funds both to buy and reclaim a surprising number of areas using those funds.

- It is also a taxing authority, with power to raise over 3$120MM a year without going to the voters. Unlike Federal money 4the Port has almost unconstrained use of this Tax Levy. It uses a small percentage of this for community grants like tree plantings and apprenticeship programs. But the majority of this money is always used to repay the Port’s own borrowing costs, thus making their actual cost of money lower than virtually any other local entity, either private or public.

- The Port is also in the real estate business. It can buy and sell land and either invest in development projects at a profit or lease the property or both.

- But at the same time the Port is itself exempt from property taxes.

Any one of these abilities is powerful, but they can also be mixed and matched to exponential advantage — and long term community harm.

Two sides of the same street

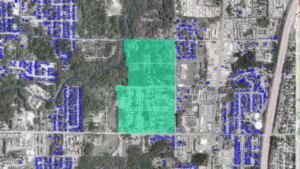

You are in Des Moines, standing at the 216th St. crosswalk looking north on 24th Ave. We’re going to look at buildings across the street from one another known collectively as the Des Moines Creek Business Park. Same developer. Similar square footages. Building design. Construction. Use cases.

East Side: Bartells/Outdoor Research

The buildings on the east side (right) are owned by private developers, including the corner building.

The buildings on the east side (right) are owned by private developers, including the corner building.

Here are the property tax distributions and payments.

Here are the property tax distributions and payments.

West Side: Port of Seattle

Now here is a similar piece of property, on the west side of 24th Ave (left). It is also leased to private tenants. But this property is owned by the Port of Seattle.

Now here is a similar piece of property, on the west side of 24th Ave (left). It is also leased to private tenants. But this property is owned by the Port of Seattle.

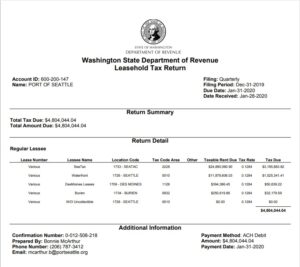

And here are their property tax distributions:

Commercial real estate developer

The Port of Seattle is not only the property owner, it is also the landlord, which means lots of ongoing, market rate lease revenue.

The Port of Seattle is not only the property owner, it is also the landlord, which means lots of ongoing, market rate lease revenue.

Every quarter, the Port of Seattle obtains $395,000 in lease payments from its tenants at the Des Moines Creek Business Park. $1,580,000 every year.

OK, but what about LET?

Leasehold Excise Tax (LET) is a special tax created by the state in order to provide for exactly this situation: tax-exempt agencies like the Port profiting from tax-free property. The state receives 12.4% and then sends 53% of that back to the City of Des Moines. This adds up to about $89,112 annually for the City of Des Moines for the entire business park.

Two Sides Of The Same Street

|  |

|

| Port of Seattle Property (west of 24th Ave.) | Private Owner (east of 24th Ave.) |

|

| Lot Size | 490,456 | 399,349 |

| Appraised Land Value | 0 | $56,260,000 |

| Property Tax | 0 | $707,650 |

This is land that your Federal tax dollars paid for, as part of the Sea-Tac Communities Plan.

It gets worse

Property buyouts, from the FAA and WSDOT, are particularly difficult for both cities and schools because every parcel of land surrendered means less property taxes for the city and the school districts. Forever. In the case of the Des Moines Creek Business Park that has meant

- The loss of hundreds of homes, amounting to millions of tax dollars over the decades.

- The loss of thousands of trees, replaced by asphalt parking lots which damage the environment.

Why would cities agree to this?

The theory behind these real estate deals is to help the Port meet its twin goals of jobs and economic growth. This is the very definition of trickle down economics. The argument has been that the benefits of these projects to their partner cities will also offset any tax breaks or environmental harms. Not quite.

One time money vs. Structural revenue

The properties were originally bought in the 1990’s and sat fallow for decades, generating nothing for Des Moines. Frankly many residents were just fine with that–opposing any commercial development–not appreciating the long-term impact. This dynamic creates a slow, but steady pressure on local governments to do something.

2Developments like these create very well-paid, but temporary construction jobs. But what makes them truly irresistible is the allure of one-time money for cities in the form of impact fees and permits.

And in the case of the Des Moines Creek Business Park, road improvements on 216th fed the notion that, eventually the city would attract more businesses into its downtown leading to renaissance for long-struggling retail businesses. This intuition was so powerful, the city failed to research and implement standard warehouse tax options until 2024!

But once the building was done, all those workers provided no meaningful increase in local taxes. Business taxes for the DMCBP mostly offset the continued decline in retail elsewhere. And ongoing jobs at the new buildings tended to be non-union – people who cannot afford to live in the host city.

However as landlord, the ongoing revenue stays with the Port of Seattle. Moreover many of the businesses in place support the airport and logistics, meshing well with their long term strategic goals.

The FAA funded the DMCBP buyouts because in 1991 planners considered it too noisy for residential use. However, land immediately west and south (directly across the street) continued to be just fine? Even after the Third Runway added new flights directly over the area, in 2012, the City of Des Moines went so far as to abandon any sound code requirements, leading to new developments such as these 2023 town homes with less protection than older homes with Port Packages. This raises yet another uncomfortable discussion, both as to the arbitrary nature of noise density guidelines and how much governments have taken the issue of airport impacts on their communities.

The FAA funded the DMCBP buyouts because in 1991 planners considered it too noisy for residential use. However, land immediately west and south (directly across the street) continued to be just fine? Even after the Third Runway added new flights directly over the area, in 2012, the City of Des Moines went so far as to abandon any sound code requirements, leading to new developments such as these 2023 town homes with less protection than older homes with Port Packages. This raises yet another uncomfortable discussion, both as to the arbitrary nature of noise density guidelines and how much governments have taken the issue of airport impacts on their communities.

What was supposed to happen

In 1973 the FAA acknowledged the vicious cycle of conflict between airports and communities. Airport operators never bothered with communities before acting, instead making the cost/benefit analysis that it was better to act and wait for communities to sue. Worst case? A suit might be successful and the airport would compensate an individual property owner using FAA grants.

The Sea-Tac Communities Plan

The Sea-Tac Communities Plan of 1976 was supposed to break that cycle. The idea was to develop an equitable system whereby harms could be minimized and mitigation could be negotiated in advance. As operational revenue increased, communities would share in some form of ongoing and progressive compensation.

The Sea-Tac Communities Plan of 1976 was supposed to break that cycle. The idea was to develop an equitable system whereby harms could be minimized and mitigation could be negotiated in advance. As operational revenue increased, communities would share in some form of ongoing and progressive compensation.

What did happen

Instead? Local governments reverted to the same economic benefits arguments. Small grant programs, funded with our own property taxes through the Port’s Property Tax Levy. But those grants are literally the Port redistributing our own taxes; and almost always for projects which ultimately benefit the Port more.

Except for the City of SeaTac

Ironically, through their Inter-Local Agreement with the Port, the City of SeaTac achieved what the entire area was meant to have–a system of ongoing, predictable, structural revenue to the entire region. And a major portion of that agreement is also funded by the property tax levy. Every King County property owner pays about $1 a year to compensate the City of SeaTac for its airport impacts. Why other cities do not is a question worth asking.

To be fair

This has not always the case. In some instances, Port developments have been genuinely beneficial for partnering communities. However, at bottom, the Port’s systems always include a quid pro quo that meet their interests. It is up to each partner to carefully assess the benefits on their side of the negotiation.

That is almost impossible given the power differential and the harsh reality of local budgets. It is asking too much of local governments not to fall prey to magical thinking that the benefits of these projects will eventually outweigh the various harms.

We call this ‘municipal vampirism’ because the life blood of any city is property taxes. It is the key to maintaining local services and good public schools. There are significant impacts beyond noise and pollution and it is time to address these head on. If that life blood is drained, few cities or school systems can hope to thrive.

The Port’s system of property acquisition and grant-based compensation sucks out essential energy and makes itself stronger.

The most insidious part of this whole strategy is that the Port is able to tout all its great work for King County on media outlets. Since few politicians have been able to resist the one-time money and “the golden shovel” photo-op; the Port, like the Count, has usually had no need to ‘hard sell’ or compel anyone to do anything.

Dracula is always invited in.

Alternatives…

The current system is literally “rich governments get richer”. But ironically, it was nothing a city could not do given the proper ‘hand up’.

Governments like Des Moines can also lease property to private tenants–and still generate the same leasehold excise tax benefiting the state. If a city could develop such projects, they would not only generate structural revenue, but also far more tax revenue to benefit the entire region.

If the Port had truly wanted to provide ‘economic development’ for Des Moines, it would have provided that ‘hand up’. But both the City and the Port instead chose a hand out.

1Bram Stoker’s Dracula, chapter 18. Dracula’s powers are seductive, but ultimately, all his victims must ask to be taken.

2In fact, most cities recognize the moral hazard in this incentive structure and set aside one-time money for their own long-term capital projects. Otherwise, the urge to use one-time money to pay for salaries can have devastating consequences.

3To be fair, the Port has almost never gotten close to that maximum. The 2023 Budget, allocates $82MM. Keeping that number below 70% of the maximum in recent years has been touted as the Port showing sensitivity. They also are fond of pointing out what is, in their mind, the minor impact for each homeowner.

4Contrast this with cities which must go to voters for almost any tax increase. And even then, generally must ask for small, specific purpose taxes.

Just a suggestion – I sent the question about Eatonville so I am not near the area but …you lay out a compelling case that leads me to my suggestion – I was looking for a “What You Can Do” section. I assume I can’t write a King County elected official or anything (since I am not in KC) but if there is something – I’d love to know because the planes that leave SeaTac or any airport, continue the effect of pollution (noise and otherwise) over the entire flight. I was camping in Idaho a few years ago and we were hundreds of miles from any major airport but I remember talking to my husband about the hearing a few planes go over – they were high but when you take away the other noise pollution (highways, barking dogs, loud music, factories, etc,) suddenly you can hear everything else – which at that time, included planes at 30K feet over the middle of Idaho. So, if there is something people can do – even those who live under the ‘cruising’ flight path – my suggestion is to make a section so people everywhere can do something, if there is anything. Many times people feel helpless – big government and little people so people, like me, assume there is no choice but to accept it. Just my thoughts, in case it helps.

A general comment for future readers to consider – the area of the nation that has no major airport such as MT still has incredible tourism. Plus, in my experience when I am on a plane – it seems like the majority of passengers fly for work (and I am guilty of flying for work unnecessarily – but will reconsider in the future). Plus, I’d ask if the tourism dollars are worth it the cost…long lines, traffic, environmental, noise, etc, etc, The costs are higher than we often realize. Just a thought to consider.