A new Boeing 787 Dreamliner in Everett in 2020. Some experienced engineers who designed this plane are weighing retirement as a big cut to their lump-sum pension payout looms later this year. (Mike Siegel / The Seattle Times)

Boeing may see hundreds of veteran engineers retire this fall ahead of a pension adjustment that will dramatically slash the payouts to those who choose to take the money in a single lump sum.

The interest rates used to determine the lump sum will be updated in November, after which one 35-year Boeing employee calculates that his payout will be cut by more than $200,000.

His base salary in 2023 would barely make up that difference.

“I’d be working another year for free,” said the engineer, who asked not to be named to keep his finances private.

A high-grade engineer designated an associate technical fellow, he’s only 57 and loves his job. “It’s been fun,” he said. But he now plans to retire at the end of November.

“To recover that kind of money, in the short time I was going to work before I retired, would not be possible,” he added. “That’s lost money.”

He said many colleagues about his age have done a similar financial calculation and “are going to bail this year.”

When the COVID-19 pandemic hit in 2020, Boeing cut about 2,900 engineering and technical employees in the region through attrition and voluntary buyouts.

Now, with the aviation business springing back amid an acute industry labor shortage, Boeing is scrambling to retain experienced engineers.

It has offered stock options and retention bonuses to top talent. And last year, the company handed out $22 million to engineers in promotions and out-of-sequence pay raises — triple the amount required in the union contract and providing an average additional raise of $10,300 to about 20% of its local engineers.

Yet the cold financial math of the pension deadline brings the prospect this year of higher than normal attrition among some of the most experienced Boeing engineers.

Members of Boeing’s white-collar union, the Society of Professional Engineering Employees in Aerospace, have the option to take their pension either as a lump sum or fixed income monthly checks for life. Typically, about half want the lump sum.

Matt Kempf, senior director for compensation and retirement for SPEEA, estimates around 600 or 700 experienced local engineers and technical staff close to retirement will have to at least consider an early exit.

“The fact that you might lose $200,000 or $300,000 can really shock you,” Kempf said. “Some people might not believe it, but it is really happening.”

“Our folks have a decision to make, go or no go,” he added. “If you want the lump sum, 2022 is the time to go.”

For those on the brink of retirement, the pension calculation provides a hefty nudge to jump now rather than later.

A 60-year-old senior airplane safety engineer, with 34 years at Boeing, who also asked not to be named to preserve his financial privacy, said the pension hit has “pushed my plans for retirement ahead.”

“I feel very bad about having to leave because I really care about this team,” he said. “They are quality people.”

But when the prospect of losing as much as one fifth of his lump sum retirement payment became clear, he said, “I decided, it’s time.”

Pension calculations

This looming cut to the pension lump-sum payout is not unique to Boeing. It applies to any similar traditional pension plan.

However, typical public employee pension plans, such as Washington state’s Public Employees’ Retirement System do not offer a lump-sum alternative to the monthly pension checks, so the dilemma facing the Boeing engineers doesn’t arise.

Likewise, Machinists union members at Boeing don’t have a lump-sum option in their plan and are unaffected.

Most Read Business Stories

- Billionaire no more: Patagonia founder gives away the company VIEW

- Pilots at Alaska-owned Horizon Air win huge pay hikes in new contract

- Boeing documentary shows a company and system primed for disaster

- Price increases are slowing in Seattle. Here’s why you haven’t noticed

- Trump openly embraces, amplifies QAnon conspiracy theories

The separate pension plan for managers and nonunion staff at Boeing does have a lump-sum option. However, that option is less attractive than the SPEEA plan, which provides a higher lump-sum payout, and so fewer people will opt for that.

Still some managers, especially those who are former SPEEA members with years of credit in the union plan, will face a similar decision to that of the engineers.

The calculation as to what lump sum is equivalent in actuarial terms to a lifetime of monthly checks varies with interest rates, under a formula set by the Internal Revenue Service. When rates go up, the expectation is that a lump sum invested will yield higher growth and so a lower amount is granted.

The interest rates on the pension plan for SPEEA members at Boeing adjust once a year, each November. Anyone retiring before the end of November will get a lump sum based on last year’s interest rates. The lump sum for anyone retiring in December will be calculated off the much higher interest rates coming with this November’s adjustment.

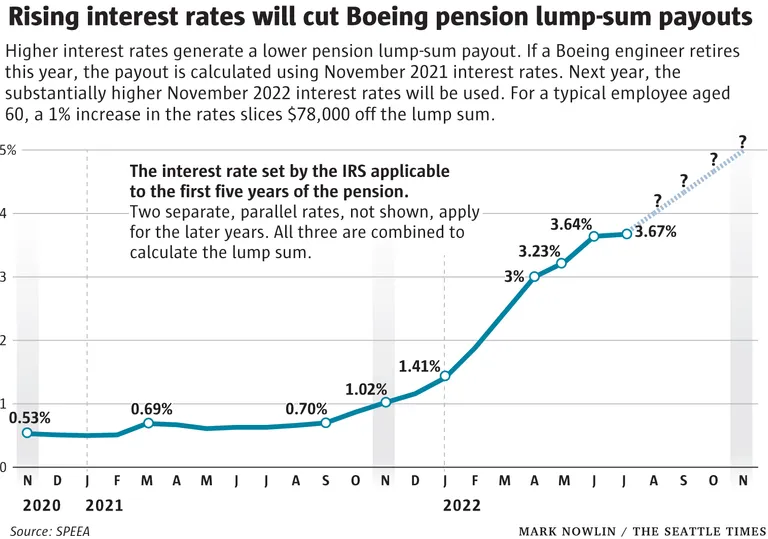

Kempf calculates that, for a typical employee aged 60, a 1% increase in the rates slices $78,000 off the lump sum.

The rates used are complex with three different components. All have surged this year, rising steadily each month.

The first rate segment has more than tripled, from 1.02% last November to 3.67% in July.

The trajectory of increases shows that rate could reach 5% by November. That would yield a massive cut to the lump sum of more than 25%.

A fraught choice

The size of the lump sum and of the annuity in the pension varies according to age, years of service, pay scale and other factors.

Typically, in round figures, this could be a choice between a $1 million lump sum that goes into the employee’s 401 (k) retirement account versus a fixed $5,000 check each month for life.

In recent years, about half of Boeing’s engineers have chosen the lump sum. And this year, with inflation on the rise, even more of them are asking about that option, said Jim Falcone, managing director at Fulcrum Wealth Advisors in Bellevue, which caters to Boeing employees.

That’s because the annuity in the SPEEA plan doesn’t have a cost of living adjustment. The amount of the monthly check is fixed through the life of the pensioner, and so its value decreases as inflation raises prices.

Taking the lump sum and investing it is a way to try to beat inflation — though as attested by the stock market’s performance this year, it comes with the risk of market losses.

The choice between a lump sum and fixed monthly checks is influenced by many factors, including tolerance for risk and life expectancy.

The size of the lump sum is based on broad actuarial data about people the same age as the employee. But if, for example, an individual is in ill health, taking the lump sum would make much more sense than it would for someone who assumes longevity.

Loving and leaving

Stephen Emanuels, a founding partner at EQ Wealth Management of Mercer Island, which specializes in financial and retirement advice to Boeing employees, cautioned that individual circumstances vary greatly.

For some employees, continuing to work for several years and then choosing a lifetime stream of monthly checks could be the best choice, he said.

“This is not a slam dunk decision,” said Emanuels. Retiring this year “is in no way a blanket recommendation. There are too many factors that need to be considered.”

“That being said, I think there is a community of engineers that are in the right age category, that are probably already contemplating their retirement, in which case, this is something that class of people really should take a hard look at,” he said.

The departure of such a seasoned group could leave holes in certain areas of critical experience at Boeing.

“You’d have to believe that there’s a staffing issue associated with it,” Emanuels said.

Boeing spokesperson Jessica Kowal in an emailed statement said “decisions about when to retire and how to receive retirement benefits are deeply personal and unique to the individual.”

“We are confident in our ability to retain top talent and our pipeline of future employees,” she wrote.

Indeed, for an employee who enjoys the work, picking the moment to retire is always a fraught decision.

That’s the case for the associate technical fellow, who says he’ll work until the last day before the pension hit kicks in at the end of November.

He’s been with Boeing for a third of its storied history, working multiple commercial airplane programs as well as high-profile military and space projects.

“I was a part of that history,” he said. “I helped shape some of that.”

One regret he has is that he won’t get to work on the launch of one more new commercial jet. The global pandemic has pushed Boeing’s plan for a new plane to the back burner.

“I had originally planned to retire maybe towards the end of a new airplane program, just to put a period or an exclamation point at the end of a career,” he said. “It doesn’t look like that’s going to happen now.”

Still, he doesn’t find it easy to let go of Boeing. The pension issue clarified a hard decision.

“You’re leaving something that you’ve put your heart and soul and your life into. And mentally you weren’t there yet,” he said. “I was starting to get there. But now it’s hitting home that, yeah, this is too big of a hit to take.”

Dominic Gates: 206-464-2963 or dgates@seattletimes.com; on Twitter: @dominicgates.