Article Summary:

Gov. Jay Inslee, burnishing his environmental credentials, will speak at the Paris Air Show Monday and Tuesday about Washington state’s lead role promoting sustainable aviation in the response to climate change.

He’ll have the attention of industry leaders in Paris, including Airbus and Boeing, who are increasingly focused on cutting carbon emissions to avoid governments imposing limits on aviation’s decadeslong growth trajectory.

“We have to solve this problem,” Inslee said in an interview before his trip. “You won’t find climate deniers in the C-suites of these companies. They get it.”

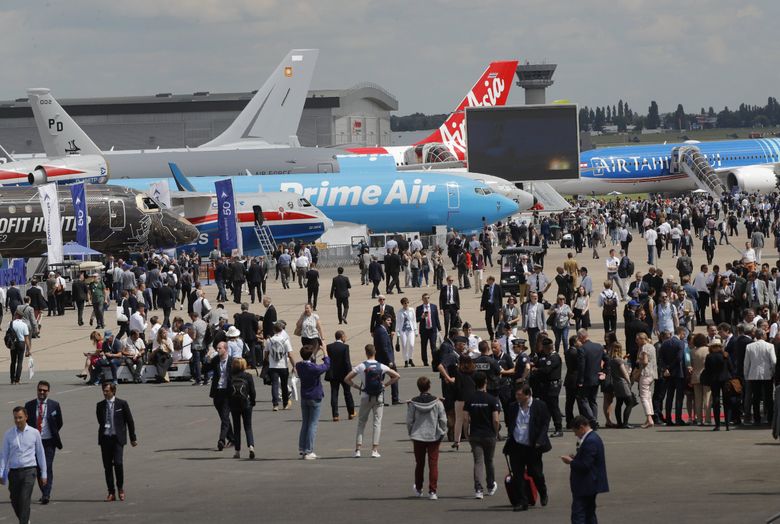

For the first time since 2019, Inslee heads a large Washington state delegation traveling to the world’s premier aviation show, which opens Monday at the historic Le Bourget airport northeast of Paris.

Each day, military jet fighters — including the U.S. F-35 — will ignore the sustainable aviation marketing message and blaze into the sky with afterburners spitting fire.

Majestically slow in comparison, commercial jets — including Boeing’s not-yet-certified 737 MAX 10 and 777X airplanes — will wheel around the airfield in challenging maneuvers no airline pilot would be allowed to do.

Below, in prefab “chalets” alongside the runway, Airbus and Boeing will host airline customers and announce the deals struck at lavish Paris hotels.

With post-pandemic air travel booming, large jet orders are likely. Airbus, on its home turf, will aim for a big show.

Yet, order news out of the show, though certainly a boost for both jet makers, will be less central than usual. Airbus and Boeing already have order backlogs stretching years ahead.

More than new sales, both manufacturers in Paris need to offer reassurance they can overcome supply chain and quality problems to deliver planes and feed the surging demand.

Boeing particularly must convince frustrated airline leaders that recent manufacturing defects won’t continue and set back production further.

CEO Dave Calhoun recently offered hints that once the inventory of undelivered 737 MAXs and 787s is cleared, Boeing’s assembly plants and its workforce will be positioned to ramp up production significantly.

Aviation’s existential focus in Paris is also Inslee’s concern: climate change.

Environmental groups, especially in Europe, are pressuring governments to curtail flying. Climate activists in May chained themselves to aircraft to disrupt a major business jet show in Geneva. Similar protests could surface in Paris.

Airlines and jet manufacturers, as well as the U.S. government and Washington state, are placing a big bet on renewable fuels — known in the industry as sustainable aviation fuel, or SAF — as they aim to achieve “net-zero” emissions by 2050. To reach net zero, the industry must cut its greenhouse gas pollution deeply and offset remaining emissions, so its overall climate change contributions are negligible.

The challenge is that aviation, so critical to Washington state, is “one of the hardest parts of our economy to decarbonize,” Inslee said.

For large aircraft, hydrogen power is considered too far off and battery power infeasible, so SAF has to be aviation’s main driver of emissions reduction.

But the investment needed between now and 2050 to provide the necessary industrial scale is staggering, well over $1 trillion.

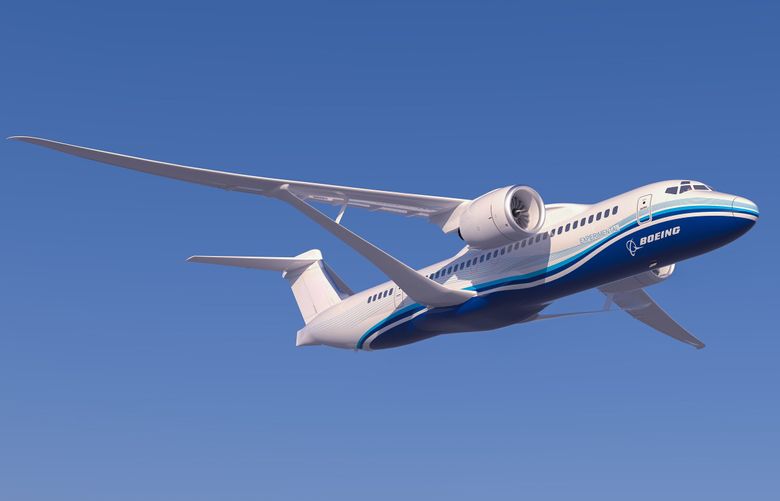

In Paris, there’ll also be discussion of radical new design concepts for aircraft — electric power, hydrogen power, open-rotor engines, urban air taxis, pilotless flight and planes with very long, slender wings — some aimed at changing the climate debate calculus.

Could the open-rotor technology or the new wing design be ready in time for Boeing’s future airplanes? This will be a Paris Air Show with indications of new directions for aviation as it faces an uncertain future.

Aviation moves on climate change — slowly

In 1927, Charles Lindbergh landed at Le Bourget after the first solo flight across the Atlantic, heralding aviation’s tremendous social, economic and cultural impact in the following decades.

This year at Le Bourget, acclaim for how aviation connects the world will give way to a discussion of what must be done to reduce its environmental impact.

The industry has developed a multistep pathway to its ambitious goal of net zero by 2050, with 65% of total emissions reduction projected to come from the use of SAF.

SAF can be produced from nonfood crops and agricultural or municipal waste. It can also be synthetically made by combining hydrogen with CO2 captured from the atmosphere.

he problem for airlines is that very little SAF is available at any price.

A variety of SAF creation methods are under development but production remains embryonic.

To promote aviation sustainability, the European Union’s policy principle is, “The polluter pays.”

It’s pushing airlines to decarbonize through regulations that cap emissions and mandated increased SAF.

At a March conference, Carsten Spohr, CEO of German carrier Lufthansa, complained about the absence of government financial support to meet these standards, saying the effect of the mandates will be “forcing us to buy nonexistent volumes of SAF at crazy prices, five times as much as fossil fuels.”

At this month’s annual meeting in Istanbul of global airline trade group IATA, the International Air Transport Association, Director General Willie Walsh said, “I think it’s fair to portray the EU as being anti-aviation.”

Airlines much prefer the U.S. approach, which is to offer tax credits and other incentives for SAF production.

At the federal level, that’s through the Inflation Reduction Act. At the state level, California and Washington are at the forefront.

Washington recently enacted laws to provide tax credits and streamline permitting for new SAF production facilities and funded a Washington State University SAF research facility in Everett. Those moves spurred Dutch company SkyNRG to pick the state for its proposed $800 million SAF plant.

Nikita Pavlenko, fuels program lead with the research nonprofit the International Council on Clean Transportation, praised Washington’s tax credits for being based on an assessment of the total carbon emissions in the fuel’s life cycle.

The subsidy “is going to those fuels which offer the deepest greenhouse gas reductions,” he said.

Still, like many environmentalists, Pavlenko favors the EU approach over the U.S.

The U.S. subsidies “are going to be fickle and unpredictable,” he said. “A change in who’s in office could make a big difference on the levels of subsidies available for SAF.”

In contrast, Pavlenko said the European mandates give SAF producers and investors “long-term policy certainty that there’s going to be a market for their fuel” and hence a reason to invest in production.

IATA estimates the world produced about 79 million gallons of SAF last year. For perspective, at a Boeing sustainability conference last month, Chief Sustainability Officer at United Airlines Lauren Riley said that carrier alone uses about 4 billion gallons of fuel annually.

To meet the net zero target, IATA projects production needs to reach around 9 billion gallons per year by 2030 and 119 billion gallons in 2050.

That means building enormous facilities across the world.

The Geneva-based Air Transport Action Group — representing the entire aviation industry, including airlines, manufacturers and airports — estimates scaling up to the level of SAF needed in 2050 will require a total worldwide investment of $1.45 trillion.

Unfazed by that stunning figure, Haldane Dodd, the group’s executive director, said that’s only a $48 billion investment per year, or about 6% of average oil and gas capital expenditure every year. Saudi Arabia oil giant Aramco made that much profit in three months last year.

“This money exists in the oil and gas industry, let alone the capital markets,” Dodd said. “The money is out there.”

In short, the aviation industry is depending on others to invest enormous sums.

Finnish oil and renewable energy company Neste last month opened an expanded refinery in Singapore with a capacity to produce 330 million gallons of SAF per year.

However, the world’s largest oil corporations have so far only experimented with SAF on a small scale.

Startups like SkyNRG and California-based Fulcrum are acting faster, gathering investment from capital markets to open SAF production plants.

Still, the sustainable fuel has yet to flow in any significant quantity.

Prospects for a Boeing recovery

Another element of aviation’s decarbonization plan offers direct near-term benefits to Airbus and Boeing.

It entails airlines restocking fleets with more efficient planes, namely Boeing 737 MAXs and 787s or Airbus A320neos and A350s.

Stand by for orders in Paris, where airlines will get to boast about reducing emissions by buying new jets. Of course, the real driver is that airlines are short of planes as post-pandemic air travel surges.

At an investor conference this month, Boeing CEO Calhoun said “demand is getting fed by an enormous amount of activity in the Middle East and in India.”

Saudi Arabia, newly eager to spend its gigantic sovereign wealth fund, is negotiating a big narrowbody jet order to add to the widebody order for 78 Boeing 787 Dreamliners announced in March.

This month, Emirates President Tim Clark said the carrier plans to order 100 to 150 big widebody aircraft in 2023.

“Whichever market we look at, there’s growth coming at us,” Clark said on Bloomberg TV this month. “So we’re short of capacity.”

Clark went on to voice the frustration of all the major airlines that both Airbus and Boeing are not delivering enough planes.

The jetmakers must “build the aeroplanes at the pace that their contract commitments require them to do without compromising quality,” he insisted.

Boeing Commercial Airplanes CEO Stan Deal will have to deliver assurances in Paris that the company can sort out its supply chain problems to ramp up to the production targets of 50 MAXs and 10 Dreamliners per month by late 2025 or early 2026.

Calhoun said at the June 2 investor conference that “confidence is growing every day, but we still run into month-to-month issues. I have to pause production when that happens.”

Four days later, news surfaced of a quality defect in the 787 Dreamliner that will delay deliveries of the jet by a matter of weeks.

Yet Calhoun offers an optimistic outlook on recovery once the extensive rework on about 90 undelivered 787 Dreamliners and 225 MAXs is complete.

Briefing journalists in South Carolina at the end of May, Calhoun said the number of mechanics assigned exclusively to that rework is a drag on production.

His optimism flows from a conviction that Boeing can be clear of this repair work by the end of 2024. Boeing is now consolidating all the 787 rework in Everett.

Separately, it is preparing to add a new 737 MAX assembly line in Everett and will add a second 787 line in South Carolina.

Calhoun said the end of repair work and new assembly lines could supercharge Boeing production in 2025.

“If the supply chain can keep up, I want to be ready,” he said. “I want to have people in place, and I want to have the physical plant in place.”

In short, while Boeing must slog through the next 18 months, it’s gearing up for better times.

Futuristic concepts

Beyond today’s generation of airplanes, new aviation technologies are on the horizon, some propelled by the pressing need for more sustainable power sources.

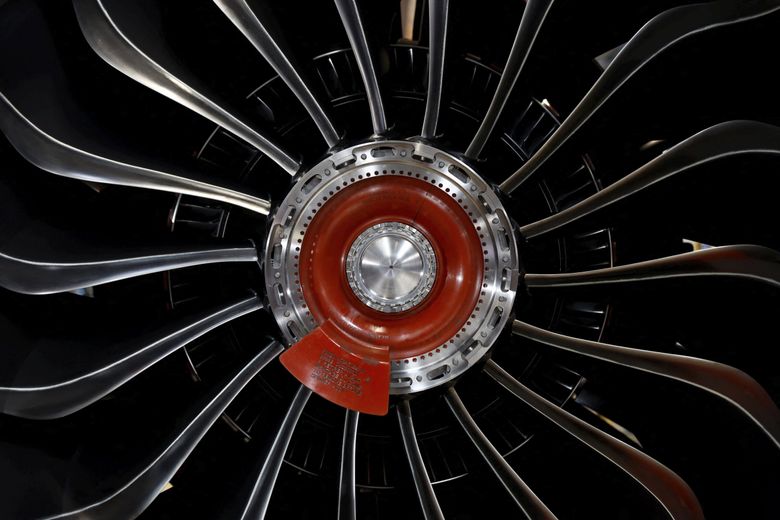

CFM International — the joint venture between General Electric and Safran of France that makes all the engines for Boeing’s MAX and half or more of the engines for the Airbus A320neo family — will give an update on one such project before the air show officially opens.

CFM’s Revolutionary Innovation for Sustainable Engines, or RISE, project is developing an open-rotor jet engine, meaning it has a fan with very large rotating blades not enclosed in a pod as on current engines.

Such a fan could be much more fuel efficient, but the engineering puzzle is to ensure it doesn’t increase noise and that passengers are safe if a blade breaks in flight. Calhoun said his confidence is growing that CFM can pull it off.

“Our job now is to figure out how to accommodate it with a different wing concept,” he said.

CFM’s new technology may or may not mesh with the radical new wing configuration Boeing has developed with NASA, called the Transonic Truss-Braced Wing, which Calhoun recently said might be ready for the next all-new jet.

Another topic to be explored in Paris will be hydrogen power.

ZeroAvia CEO Val Miftakhov, who will be in Paris, is developing a hydrogen-powered version of a Bombardier Q400 turboprop donated by Alaska Airlines.

Universal Hydrogen, the company that flew a hydrogen-powered ATR 72 regional turboprop at Moses Lake in March, flew the plane a second time this month. Universal’s Chief Technology Office Mark Cousin will be in Paris.

Airbus may offer a progress update on its efforts both to develop a hydrogen infrastructure at airports and to build demonstrator aircraft.

Meanwhile, just as at the Farnborough Airshow last year, “flying taxis” being developed will be on display at Le Bourget. A year further on, Germany’s Volocopter will actually fly a prototype, the two-seater Volocity VC200.

The news that will matter

Whatever airplane orders come through in Paris, realize that ostentatious sales announced at air shows often end up delivering far less than promised.

At a memorably raucous affair during the 2011 Paris Air Show, AirAsia CEO Tony Fernandes described partying with top Airbus executives as he sealed a massive deal for 200 hot-selling A320neos. He later raised the total order to more than 400 jets, of which 366 were converted to the largest A321neo model.

A dozen years after that air-show circus, Airbus has delivered to AirAsia 28 A320neos and just four A321neos.

At the 2019 Paris Air Show, just three months after the second crash of a 737 MAX in Ethiopia, IATA’s Walsh — then-CEO of British Airways parent company International Airlines Group — delivered an emotional testament of faith in Boeing when he announced a commitment to buy 200 MAXs.

Less than a year later the world was devastated by the COVID-19 pandemic and that commitment receded from memory. Last fall, the International Airlines Group finalized an order for just 50 MAXs. None has been delivered.

Rather than sales announcements in Paris, the underlying problems causing anxiety in the industry will deserve more attention.

Those are the wobbly supply chains, the sluggish airplane production, the fear of climate-related growth restrictions, the immensity of the task to scale up SAF production and the time and investment needed to certify new technology concepts.

At a worrying moment, Le Bourget should offer progress reports on these consequential matters.