By

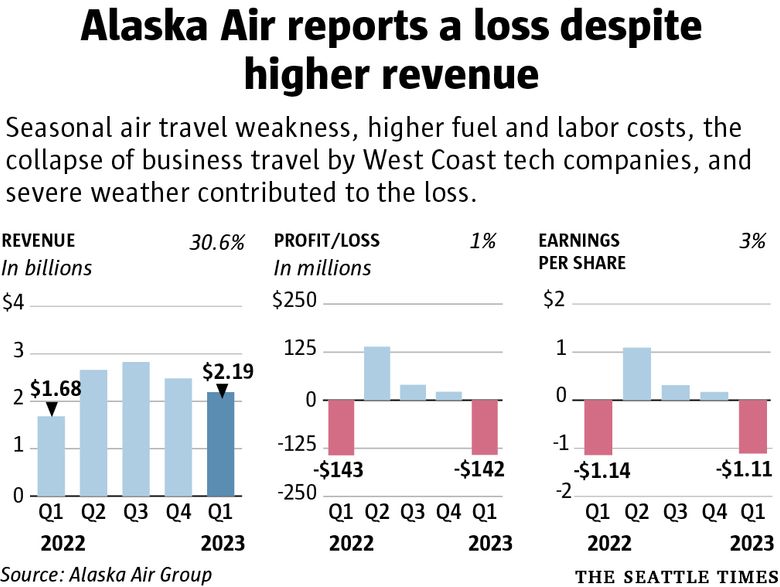

Alaska Air Group flew more passengers and took in more revenue in the first quarter of this year compared with a year ago, but it still lost $142 million.

The loss is a result of myriad factors — from seasonal air travel weakness to higher fuel and labor costs to the collapse of business travel at West Coast high-tech corporations and severe weather.

“Our loss is primarily a reflection of our current network seasonality,” said Alaska CEO Ben Minicucci.

Still, heartened by the demand and revenue trends, on Thursday the leadership at Alaska Air — parent company of Alaska Airlines and regional carrier Horizon Air — confidently projected profits for the rest of the year.

Thanks largely to higher ticket prices, while seat capacity was up 14% year over year, the first quarter’s $2.2 billion revenue was up 31%.

“This quarter we returned to pre-pandemic levels of flying and our road map to profitable growth is on track,” Minicucci said. “We have taken deliberate steps to build momentum, and we are well-prepared for peak summer flying.”

Among those steps toward profitability is reverting to an all-Boeing 737 fleet at Alaska Airlines, a move to cut pilot training costs and fuel bills.

When Alaska acquired Virgin America in 2016, it inherited 72 Airbus A320s and A321s. All the A320s are already gone, replaced by Boeing 737 MAX 9s that have 28 more seats and better fuel efficiency.

Despite flying 29 fewer airplanes than a year ago, the larger jets meant the number of seats was up 14%.

Minicucci said Alaska saved 7 million gallons of fuel last quarter “as a direct result of the superior MAX aircraft in our fleet.”

And Alaska revealed Thursday it is in advanced talks with lessors, financial firms and other airlines to offload the 10 remaining A321neos. It intends to accelerate the fleet transition to make September the last month Alaska will fly Airbus jets.

Chief Financial Officer Shane Tackett said this final stage of the switch to an all-Boeing fleet will cost between $300 million and $350 million, and the associated retraining of pilots should be completed by year-end.

And because Alaska has ordered the MAX 9, the only MAX model that’s exempted from Boeing’s latest vertical fin production flaw, those jet deliveries shouldn’t be delayed.

Alaska expects to end the year flying 6% to 9% more seats. And it is encouraged by the more than 100,000 new loyalty credit card sign-ups last quarter, the highest number ever.

Looking forward to a blockbuster summer, Alaska on Thursday projected 2023 pretax profits of between 14% and 17%.

First-quarter weakness

Multiple factors played into the $142 million or $1.11 per share quarterly loss, which compares with a loss of $143 million or $1.14 per share in the same quarter last year.

Across all U.S. airlines, January and February are always the weakest air travel months. Aside from that typical seasonal lull, Minicucci cited high fuel prices and a slump in business travel.

Jet fuel cost an average $3.41 per gallon in the quarter versus $2.62 a year earlier.

Business travel was down largely due to corporate layoffs, especially in the high-tech sector that typically fills premium seats on flights from the Bay Area and Seattle.

Labor costs were up between $75 million and $80 million in the quarter compared with a year earlier, primarily as a result of the big contract pay increases for Alaska and Horizon pilots late last year.

New contracts for flight attendants and maintenance mechanics are still being negotiated.

Then there was the impact of bad weather, which, Minicucci said, cost the airline $34 million last quarter.

“The start of this year has presented more challenging weather conditions and we’ve seen historically persistent storms, regular snow and elevated icing conditions throughout January and February,” he told financial analysts during Thursday’s quarterly earnings call.

Since Alaska has repeatedly suffered heavy flight delays and cancellations in previous winters, Minicucci said he has set a goal “to significantly harden our operational resiliency before next winter and to reduce cancels and customer impacts from weather to the greatest extent possible.”

But before that, Alaska has been preparing to cope with heavy demand this summer.

Minicucci said Alaska has doubled its pilot training throughput compared with the same period last year.

And it’s providing 14,000 flight attendants and gate agents “a one-day immersive care retreat” on how to keep passengers happy.

“We’re going to have a great summer,” Minicucci said.

Ending check-in kiosks

Executives on the earnings call Thursday highlighted a plan to get rid of Alaska’s self check-in kiosks at its major hubs, including Seattle.

The idea is to smooth congestion in the airport lobby by having passengers do much of the check-in process from home.

Passengers will check in and get boarding passes on their phones before arrival at the airport. And those who have checked bags can print the luggage tag at an iPad in the lobby.

Chief Commercial Officer Andrew Harrison said only half of all passengers check bags, and everyone else should be able to go straight to the TSA security lines.

CEO Minicucci said the “long-term vision is to have people come in, get their bag tag or have an electronic bag tag … go to a self bag drop … and get to security within under five minutes.”

Alaska said it will invest $2.5 billion for this reinvention of its airport lobbies at Seattle, Portland, San Francisco and Los Angeles through the end of next year.

The lobby revamp has already begun in Portland.

Alaska’s stock closed down 9 cents Thursday at $43.56.

Dominic Gates: 206-464-2963 or dgates@seattletimes.com; on Twitter: @dominicgates