Notes:

B. SUMMARY OF EXPENDITURE IMPACTS

Expenditure impacts of the legislation on local governments with the expenditure provisions identified by section number and when appropriate, the detail of expenditures. Delineated between city, county and special district impacts.

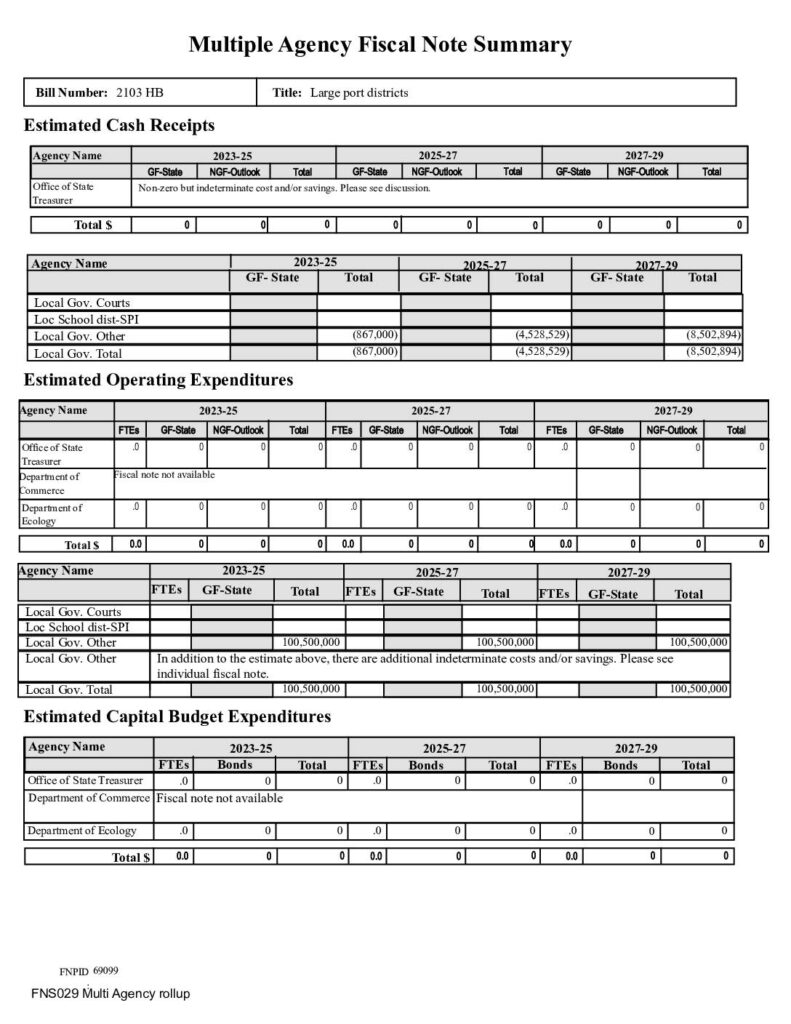

This bill majorly increases Port of Seattle expenditures by creating a new mitigation program that is expected to cost 1 billion dollars (determinately) – over 20 years – with additional indeterminate costs, according to the Port of Seattle. Additional, increased expenditures are expected for King County and are indeterminate.

SECTION 3 describes a new mitigation program that is expected to cost $1,000,000,000 dollars in total starting in FY2024 according to the Port of Seattle. For the purposes of this fiscal note, this $1B cost is illustratively compared to the implementation of another program that was implemented over a span of 20 years. To assume an amount per fiscal year,

the LGFN Program divided $1B/20 years because similar comparisons are made below ($50M/FY). Additional, indeterminate costs are expected to add to the $50M per fiscal year.

For an illustration of the scale of these expenditures, the Local Government Fiscal Note Program compares a current Port of Seattle mitigation program and it’s costs with this new, proposed mitigation program. The Port of Seattle currently operates a noise mitigation program that works to mitigate the noise for residences within an area around the airport referred to as 65DnL. There are about 10,000 residences within the 65DnL area that are eligible for the program due to their location. It costs the port approximately $100,000 for each residence that receives noise mitigation assistance through the program. As of 2023, about 9,500 residences have received noise mitigation assistance. This has cost approximately

$950 million dollars to implement in the 20+ years of operating the program. Approximately, 20% of this cost was covered by the Port of Seattle, which amounts to $190 million dollars. The other 80% was covered with federal funds.

Section 3, describes a new mitigation program that has been expanded beyond the current program in the following ways: It expands:

1. the area of eligibility from the 65DnL (exposed to 65 decibels or more) area, which currently includes about 10,000

residences to an area within a larger range 55DnL (exposed to 55 decibels of more) that includes an indeterminate number of additional eligible residences. To know the increased number of residences/buildings within a 55 decibel range sound testing will need to be performed.

a) According to an Illinois Dept. of Transportation pamphlet on traffic noise, decibels, and range, “generally, every time the distance doubles, the noise level will decline 3 dB(A) when it travels over hard surfaces. Over soft surfaces, the noise level will decline 4.5 dB(A) for every doubling of distance.” Given this explanation of how sound travels, it can be assumed that the distance from the Port to eligible residences/building with a 10 decibel difference will double twice (quadruple) when soft surfaces are between the port and the eligible residence/building.

2. the type of building eligible; from residences to residential, recreational, or educational facilities.

3. eligibility for assistance by allowing residences that have received assistance from the current program to receive additional assistance from the new program, which is currently restricted by federal law under the current program.

4. It expands the type of mitigation assistance from just noise mitigation to also include:

a) failed mitigation equipment

b) provision of air quality mitigation equipment including, but not limited to, the provision of high particulate air purifiers designed to mitigate or eliminate ultrafine particles or other aviation-related air pollution;

c) provide urban forests or green space within an impacted area;

d) provision or support of indoor recreation facilities available to the community within an impacted area; and e) provision of indoor community greenhouses within an impacted area

The section 3 mitigation program described in this bill will not be eligible for federal funds like the current mitigation program, which received approximately 80% of it’s operating expenses from the federal government. This is because current FAA regulations only contemplate noise mitigation for the 65 DnL. Current federal law also prohibits the use of federal funds or airport revenues for properties that have already received noise mitigation funding under the current program. Comparatively, the Port of Seattle covered 20% of the cost to provide mitigation assistance for their current noise mitigation program. However, the Port of Seattle will need to cover 100% (minus any state resources allocated) of the cost of this expanded program.

SECTIONS 3 and 8 mention the Port working with King County to administer a new inspection program. The inspections will be conducted at no cost to the potentially eligible person/building. Although the grant program managed by the State Dept. of Commerce (in section 6) will provide funds to complete inspections, dependent upon allocation, there will be costs to the County to procure contractors for these purposes. According to King County, and based upon their understanding of how many residences/buildings could potentially be eligible to receive an inspection, the county estimates an increase in

expenditure costs of $250,000 per year beginning in FY 2024.

SECTION 6 requires the port to perform outreach in the form of pamphlets. Pamphlets will require increase printing and mailing costs. These costs are indeterminate.

SECTION 7 requires the port to engage communities and perform assessments prior to any significant port action (any action involving a capital improvement project, purchase, or construction of $12,000,000 or more in value). These expenses are new and are indeterminate.